The principles of why Bitcoin was designed in such a way have all been covered in the previous sections. We discussed money and why gold won out through monetary darwinism. We discussed the fundamental flaw with gold that led to its capture and exploitation by government. We discussed economics and why a global economy on a sound money standard is more efficient and more equitable for everyone.

The previous three sections are far more important than this one. If you’ve made it this far, you’ve understood the “why” of Bitcoin. This section “Bitcoin Anatomy” will discuss the “how”. How was Bitcoins original architect, Satoshi Nakamoto, able to create a monetary network that not only perfected the properties of money but was also resistant to attack? A system so robust that despite constant attack for over a decade by the most sophisticated agencies, including the NSA, continues to function as designed.

Satoshi Nakamoto

Satoshi Nakamoto was the pseudonym used by the person or persons who developed Bitcoin. He began working on the Bitcoin code in 2007. On the 31st of October 2008, he first proposed Bitcoin to the world through an online forum. His white paper was concise and illustrated his proposed solution which you can find here.

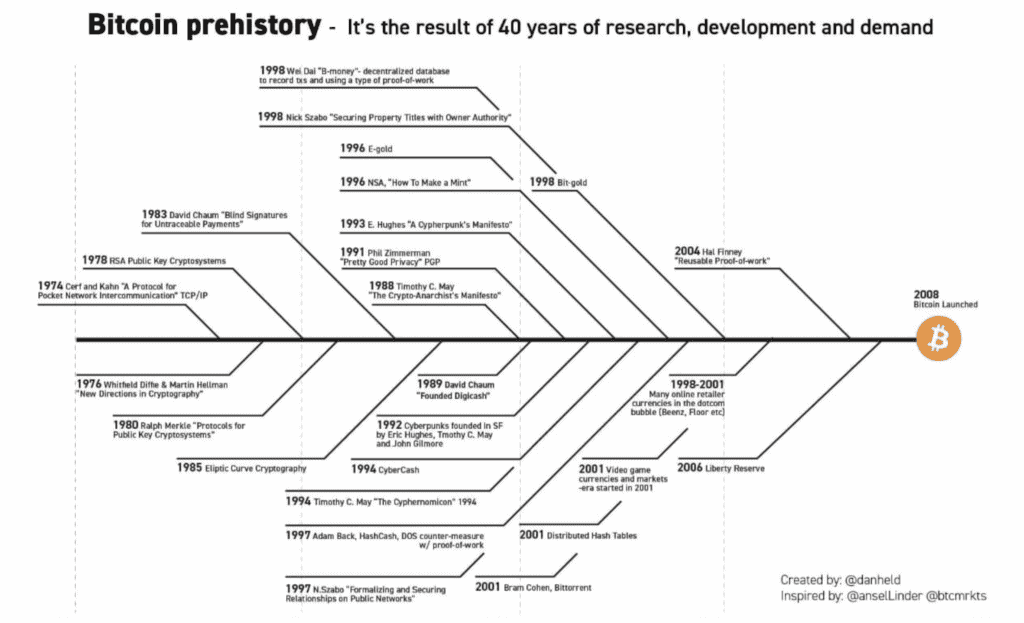

Contrary to popular belief, Bitcoin was not the first private electronic cash system. It was, however, the first to succeed. This was only possible due to foundational technologies and research that had accumulated over the last 40 years. He incorporated many of these functions and integrated his own innovation, the difficulty adjustment, which resulted in the discovery of digital scarcity in the form of Bitcoin.

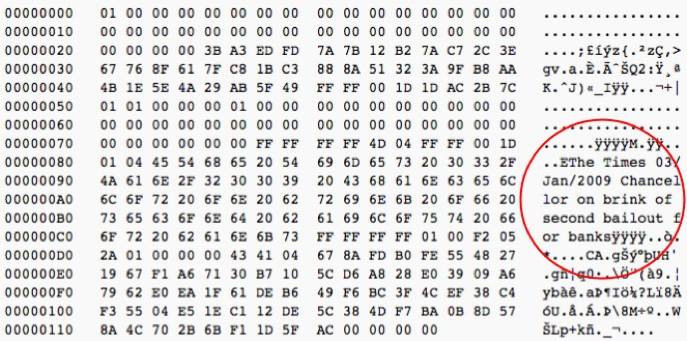

On January 3rd 2009, he launched the Bitcoin network by defining the genesis block (or the first block on the Bitcoin blockchain). In this block he embedded the text “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”. It could be interpreted as both a timestamp and a derisive comment on the instability caused by fractional-reserve banking. The government solution to the GFC, as with all crises, was to print more dollars into existence and ultimately debase the currency. It was clear Satoshi had a deep understanding of the fundamental issues that plagued our current monetary system and used that as the framework to design his solution.

In April of 2011, Satoshi left Bitcoin in the hands of the world. His last message in a private email to a developer was “I am moving on to other things and probably won’t be around in the future”. Satoshi had to be anonymous for Bitcoin to succeed. For a money to be truly neutral and accepted globally, its creator(s) cannot belong to any nation, be of any particular faith or religion or have any political affiliations. If he was American, the Russians won’t adopt it. If he was Russian, the Americans won’t adopt it. If he was christian, some muslims may not adopt it. If he was muslim, some christians may not adopt it. His anonymity was also by design.

Elements of trust

Let’s take a look at our current system and the elements of trust involved. If Bob wants to send Alice $10 electronically, what typically happens is that Bobs bank will talk to Alices bank. Both banks come to an agreement on the transaction. Bobs bank tells Alices bank that he has the funds to make the transaction. Alices bank tells Bobs bank that they will credit Alice $10 as long as Bobs bank agrees to deduct $10 from Bob. Here are the levels of trust required for this transaction to occur:

- Alice has to trust that Bobs bank will deduct $10 from Bob.

- Bob has to trust Alices Bank to credit Alice $10.

- Alices Bank has to trust Bobs Bank to deduct $10 from Bob.

- Bobs Bank has to trust Alices Bank to credit Alice $10.

- Both Alice and Bob have to trust the Central Bank not to create new dollars and devalue the $10 transaction

These issues stem with lack of transparency in the transaction itself and uncertainty systemically with frequent changes in monetary policy and politics. The issues of trust (and distrust) extend internationally where final settlement can sometimes take several days with increased transaction costs (up to 30% of the transaction value in some cases). This is due to multiple intermediaries, time zones and business hour differences, compliance checks and execution of currency exchange.

Until Bitcoin, to make any electronic payment, we have always needed a third party such as a bank to “verify” the transaction in this way. Bitcoin fixes this by having all transactions made public. This allows for anyone to verify the transaction themselves without relying on a third party. Furthermore, the rules of Bitcoin (such as the fixed supply of 21 million Bitcoin) cannot be altered by any one institution or government. Unlike a traditional bank, to generate a Bitcoin “account” does not require giving up personal information. So, although the transactions themselves are public knowledge, who is making those transactions are not.

Other issues that arise from our current banking system include:

- Privacy issues with banks being able to surveil all transactions of their customers

- Censorship of transactions. As banks need to comply with government law, transactions may be censored or accounts frozen based on political motivation (as is occurring in many parts of the world).

- Trusting the bank itself has the finances to allow you to withdraw money. All banks run a fractional reserve system, which means that the banks only have a fraction (not all) the funds they have written in their customers accounts. They rely on the assumption that there would never be a point where everyone attempted to withdraw all their money at once.

Perfecting Money

For a global economy to function efficiently, we require a money that has all the properties of a good money. One that is a good store of value like gold and a good medium of exchange like dollars so that people can price their goods and services in a reliable unit of account. All this, with a security model that makes it resistant to attack, coercion and manipulation.

Bitcoin: A truely Trustless System?

By design, Bitcoin is a system where the total supply cannot be increased. A system that allows anyone to receive money anywhere in the world without giving up personal data, and therefore does not discriminate. A system where you can send and receive a transaction without fear of censorship or confiscation of your money.

These are two key features of Bitcoin that would be helpful to remember going forward:

1. There will only ever be 21 million Bitcoin in existence.

2. A new block (set of transactions) will occur on average once every 10 minutes.

The remaining articles in this section will focus on why this is important and how Bitcoin achieves these two properties. We’ll go over some core concepts of cryptography, how Bitcoin performs transactions in a trust-less manner and Bitcoins security model.

References

- Nakamoto S. Bitcoin: A Peer-to-Peer Electronic Cash System [Internet]. 2008 [cited 2023 May 24]. Available from: https://bitcoin.org/bitcoin.pdf

These articles were designed to make these concepts more palatable. If you’re interested in reading more in-depth text into the technical aspects of the bitcoin network, consider the following:

- Song J. Programming Bitcoin: Learning How to Build Bitcoin from Scratch. Sebastopol: O’Reilly Media; 2019

- Antonopoulos AM. Mastering Bitcoin: Unlocking Digital Cryptocurrencies. Sepastopol: O’Reilly Media; 2014

Ruki is a passionate Bitcoin educator who firmly believes in the principles of the Austrian School of Economics. As a sound money advocate he recognises its benefits to individuals and society as a whole. He is dedicated to empowering those without financial access to take control and build a more secure future.