Aftermath of the Nixon Shock

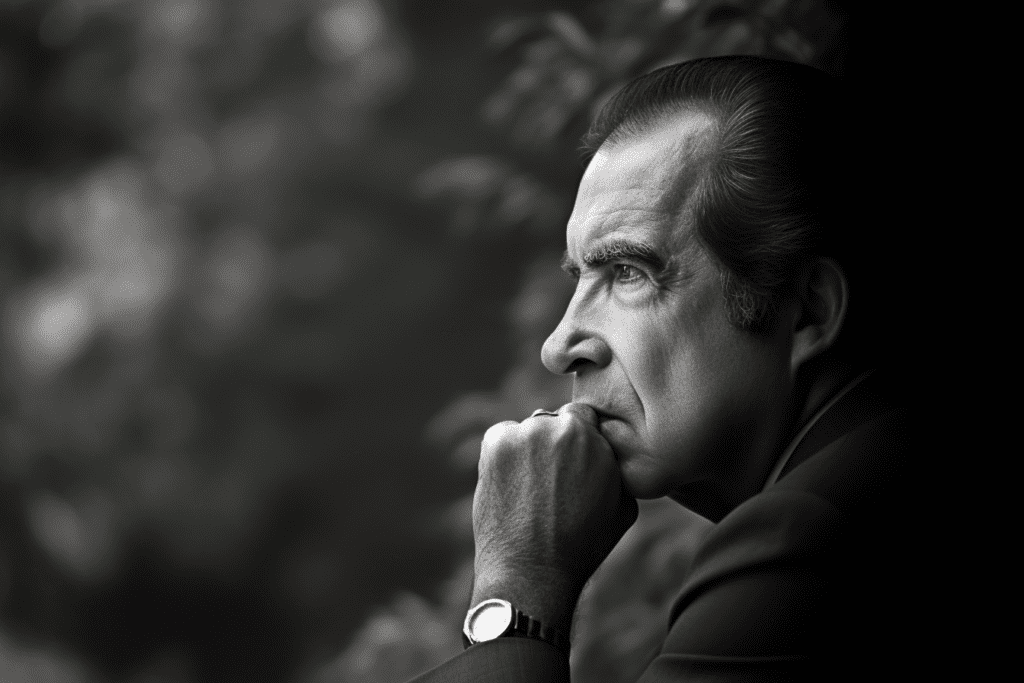

By 1971, US debt had grown too high. 11 billion dollars in gold backed 24 billion dollars.2 That August, France sent a battleship to New York City to collect their nations gold from the Federal Reserve and the UK asked Fort Knox to prepare 3 billion worth of gold for withdrawal.3 August 15 1971, president Nixon declared a temporary halt to the convertibly of dollars for gold. It immediately devalued the dollar by 10% and other countries much worse. President Nixon made his position clear: “I don’t give a shit about the Lira”.4

The sudden and unilateral decision by President Richard Nixon to end the convertibility of the US dollar to gold ended the Bretton Woods System. The global financial system was sent into chaos. Currencies that were once tethered to the USD which was once tethered to gold were now untethered. US dollars went from “I owe you” to “I owe you nothing”.5

As the gold standard crumbled, a new monetary order needed to be established to maintain US economic dominance and ensure stability in global markets. The only reason there was demand for the US dollar was because it was “worth its weight in gold”. With gold removed from the equation, there began a quest to create a new source of demand for the US dollar.1

The Petrodollar

The period immediately after the Nixon Shock was the weakest the US had been in the face of global and political pressure. Its dominance was questioned in a multipolar financial world. Enter the petrodollar. The brainchild of Nixon and his Secretary of State, Henry Kissinger, the petrodollar was a bold and innovative solution to the problems facing the US and the world at large.6 How could the US re-establish demand to keep the guns & butter spending spree going in the post-gold era?

In 1973, the Arab petroleum exporters of OPEC quadrupled the price of oil and embargoed the US for its support of Israel during the Yon Kippur War. In the space of a few years, a barrel of oil rose from $2 to $12. They were also responsible for supplying 80% of the world’s oil. At this time, the wealth of the Saudi Government was immense. This was to the point they did not know what to do with this excess wealth.6

The US saw an opportunity. In 1974, they sent the new treasurer William Simon to Saudi Arabia. He succeeded in persuading this otherwise hostile country to invest the billions of revenue generated from oil sales in US treasuries at discounted rates. They also requested that oil was to be priced in US dollars. For this, the Saudis would get military aid and equipment from the US. On June 8 1974, Kissinger and Crown Prince Fahd signed documents establishing the investment in US treasuries for military support.6,7,8

By finding a way to price the world’s oil in US dollars, countries would have to sell their currencies and buy US dollars in order to participate in the largest oil markets. By tying the value of the dollar to the global oil trade, Nixon and Kissinger aimed to create an artificial demand for US currency, thus bolstering its strength and ensuring that America retained its position as the world’s foremost economic power. Through these series of secret agreements (later declassified) with Saudi Arabia and other key Middle Eastern nations, the petrodollar system was born.6,7

The concept was simple enough. By linking the global demand for oil to the dollar, the US was able to maintain its hegemony and continue exporting manufacturing and treasuries abroad in exchange for goods and services.1 This system also enabled the US to finance its vast military spending and support its geopolitical ambitions. In the words of Luke Gromen, the petrodollar can be likened to a “company town,” where America exerted its control over oil pricing through threats and violence.6

War in the Middle-east

On September 11, 2001, America’s relationship with the Middle East changed forever, marking the beginning of a series of events that would lead to the invasion of Iraq. The U.S. government maintained that the invasion was driven by the need to combat terrorism and the threat of weapons of mass destruction. However, some researchers argue that the conflict was primarily about protecting the petrodollar system and maintaining economic power. The war in Iraq is still referred to as “A war of reasons”.9,10

Widely considered the largest protest in documented history, the 2003 anti-war demonstrations occurred in response to the United States impending invasion of Iraq. The protests were held in more than 600 cities around the world, involving millions of people. The exact number of people who participated in the protests worldwide is unknown, but it is estimated to be between 10 and 30 million people. Regardless of the massive global and domestic outcry, the US proceeded with the invasion of Iraq.11

What followed was the predictable death and destruction that comes with all wars. The Iraq campaign lasted 17 years. When it finally ended in 2020, the total estimated civilian death was reported to be in the hundreds of thousands to over a million. Estimates of the first 8 years alone attributed almost half a million deaths.12

Truth: The first casualty of war

A quote that resonates is one by H.L. Mencken written in 1918 “The urge to save humanity is almost always a false front for the urge to rule it. No one ever went broke underestimating the intelligence of the American public. The whole aim of practical politics is to keep the populace alarmed, and hence clamorous to be led to safety, by an endless series of hobgoblins, most of them imaginary.” No just war ever needed so many lies.

Authors William R. Clark and F. William Engdahl suggest that the real motive behind the U.S.-led invasion of Iraq was Saddam Hussein’s decision in 2000 to switch from dollar-based transactions to euros for its oil exports.13,14 Despite numerous official statements denying any connection between the Iraq war and oil, several prominent figures have since admitted that oil played a significant role in the conflict. These include former Federal Reserve Chairman Alan Greenspan, who stated that the Iraq war was “largely about oil,” and General John Abizaid, who also acknowledged the connection between the war and oil.15

The shift in the U.S. government’s stance on invading Iraq raises questions about the influence of oil and the petrodollar system on foreign policy decisions. While it is clear that oil played a part in the U.S.-led invasion of Iraq, the extent to which the protection of the petrodollar system influenced the decision remains a subject of debate. Given the alternative reasons and lack of evidence for them, the defence of the petrodollar system and economic interests has (so far) been the most plausible one and likely played a significant role.

Cost of US Dollar Hegemony

In the years following the invasion, the situation in Iraq has remained unstable, with ongoing conflict and political turmoil. Critics argue that the decision to invade was based on flawed intelligence and ulterior motives, leading to long-lasting consequences for both Iraq and the global community.10

Ultimately, the connection between the Iraq war, oil, and the petrodollar system highlights the complex relationship between geopolitics, natural resources, and global economic systems. As the world continues to grapple with the consequences of the Iraq war, it serves as a stark reminder of the potential costs and ramifications of foreign policy decisions driven by economic interests.

It’s important to understand that the US Dollar does not have any natural demand because it does not possess many of the fundamental properties of money. Instead, artificial demand is enforced through violence. Faith in the US Government and its “Proof-of-war” is the security model for the US Dollar.16 This is in contrast to how the Bitcoin network is secured through “Proof-of-work”.17 When discussing costs, a more accurate comparison is to weigh all costs (energy, human, and environmental) of the current monetary system that Bitcoin aims to replace. When taking this into consideration alone, Bitcoin has much greater benefits and fewer harms to the global population than the current US dollar system.

References

- Eichengreen B. Exorbitant Privilege: The Rise and Fall of the Dollar and the Future of the International Monetary System. Oxford: Oxford University Press; 2011.

- Rickards J. The Death of Money: The Coming Collapse of the International Monetary System. New York: Portfolio/Penguin; 2014.

- Pringle R. The Money Trap: Escaping the Grip of Global Finance. London: Palgrave Macmillan; 2012.

- Reeves R. President Nixon: Alone in the White House. New York: Simon & Schuster; 2001.

- Bordo MD, Eichengreen B, editors. A Retrospective on the Bretton Woods System: Lessons for International Monetary Reform. Chicago: University of Chicago Press; 1993.

- Gladstein, A. The Hidden Costs of the Petrodollar. Bitcoin Magazine. Available at: https://bitcoinmagazine.com/culture/the-hidden-costs-of-the-petrodollar

- Spiro D. The Hidden Hand of American Hegemony: Petrodollar Recycling and International Markets. Ithaca: Cornell University Press; 1999.

- Bronson R. Thicker than Oil: America’s Uneasy Partnership with Saudi Arabia. Oxford: Oxford University Press; 2006.

- Chapman J. The Real Reasons Bush went to war. The Guardian. Available at: https://www.theguardian.com/world/2004/jul/28/iraq.usa. 2008 Jul 28

- Ricks TE. Fiasco: The American Military Adventure in Iraq, 2003 to 2005. New York: Penguin Press; 2006.

- Walgrave S, Rucht D. The World Says No to War: Demonstrations against the War on Iraq. Minneapolis: University of Minnesota Press; 2010.

- Hagopian A, Flaxman AD, Takaro TK, et al. Mortality in Iraq Associated with the 2003–2011 War and Occupation: Findings from a National Cluster Sample Survey by the University Collaborative Iraq Mortality Study. PLoS Med. 2013;10(10):e1001533. Available at: https://journals.plos.org/plosmedicine/article?id=10.1371/journal.pmed.1001533

- Clark WR. Petrodollar Warfare: Oil, Iraq and the Future of the Dollar. Gabriola Island: New Society Publishers; 2005

- Engdahl FW. A Century of War: Anglo-American Oil Politics and the New World Order. London: Pluto Press; 2004.

- Juhasz A. The Bush Agenda: Invading the World, One Economy at a Time. New York: HarperCollins; 2006.

- Ammous S. The Fiat Standard: Debt Slavery Alternative to Human Civilization. Wiley, 2021

- Nakamoto S. Bitcoin: A Peer-to-Peer Electronic Cash System. 2008. Available from: https://bitcoin.org/bitcoin.pdf

These articles were designed to make these concepts more palatable. If you’re interested in reading a more in-depth perspective on the transition to fiat currency, consider the following:

ENDEVR. “End of the Road: How Money Became Worthless.” Youtube documentary, https://www.youtube.com/watch?v=NJd6RKsY5H4

Saifedean Ammous, “The Bitcoin Standard: A Decentralised Alternative to Central Banking”. Wiley, 2018

Saifedean Ammous, “The Fiat Standard: The Debt Slavey Alternative to Human Civilization”. Wiley, 2021

Investopedia. “How Petrodollars affect the US dollar.” https://www.investopedia.com/articles/forex/072915/how-petrodollars-affect-us-dollar.asp

Wight, D.M. “Oil Money: Middle East Petrodollars and the Transformation of US Empire, 1967–1988.” New York: Cornell University Press, 2017

Gladstein, Alex. “Uncovering the hidden costs of the Petrodollar.” Bitcoin Magazine, https://bitcoinmagazine.com/culture/the-hidden-costs-of-the-petrodollar

Ruki is a passionate Bitcoin educator who firmly believes in the principles of the Austrian School of Economics. As a sound money advocate he recognises its benefits to individuals and society as a whole. He is dedicated to empowering those without financial access to take control and build a more secure future.