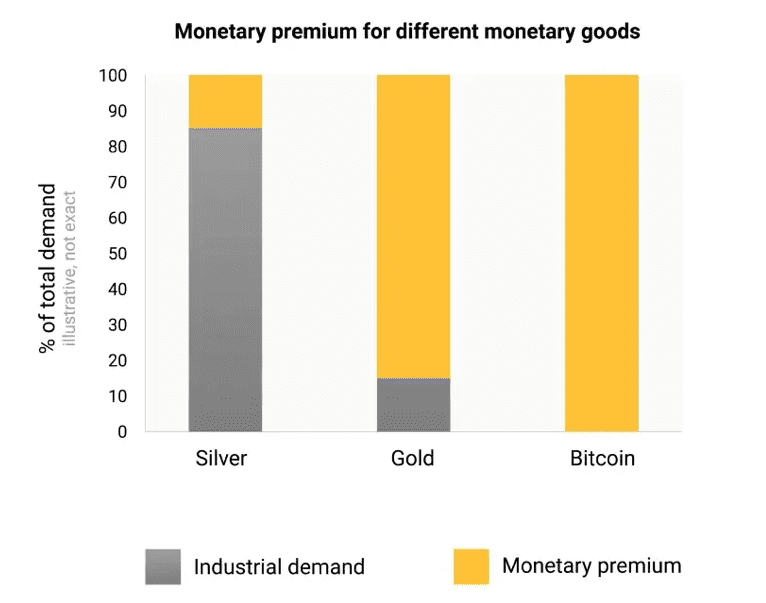

Monetary Premium

Being a monetary good is a tool and so serves a purpose (to acquire other goods). It could be argued that a tool that allows you to acquire almost anything else would be considered one of the most useful goods on the market. With that usefulness comes added demand and also value. This could be considered a type of “monetary premium” on top of the value for its industrial use.3 Vijay Boyapati discusses these concepts in his article “The Bullish Case for Bitcoin” and would recommend reading it.

Bitcoin has no industrial demand because it has no utility outside of being a monetary good. It is 100% monetary premium.3 It’s important to understand that If gold fails as money, it will still have some value (a fraction of what it’s worth today) for its industrial use. If Bitcoin fails as money, it will have no value.

The ideal money should not have any other industrial use. This can be thought of as a spectrum. The more it is used, the worse it is for society.3 Imagine if we used copper as money. Copper is extensively used throughout many industries. If we added a monetary premium on such a commodity, it would add cost to anything that involved copper and so reduce profitability overall for any copper-related project. This won’t stop innovation, but will certainly slow its progress significantly in many disciplines.

Properties of Good Money

We’ve identified why monetary goods command a premium over other market goods. But how did gold win out over all other market goods? There are a few main properties that make something favourable to use as money. Gold just ticked the most boxes at the time. Let’s compare Gold (past money) with fiat currencies (present money) and Bitcoin (potential future money).

Durability

There is a very good reason that bananas aren’t used as money by most people. Amongst other things, it is perishable and has a limited lifespan. It can go rotten, be squashed, or eaten. Good money should be very durable, or virtually indestructible in the case of gold.3

Gold itself is an element, so to destroy gold would take enormous amounts of energy to rip its protons and neutrons apart. It is also very inert and tends not to react, unlike other elements like sodium, which will oxidise rapidly with oxygen and change its chemical properties.

Fiat currencies (cash) have value as long as there is a government to enforce their use. If a government collapses, so too does its currency and faith in its value. Even though there are stronger currencies like the US dollar, globally the average fiat currency has a lifespan of 27 years.4 Unfortunately, this also means a significant population of the world experiences the consequences of this including hyperinflation, an increase in violent crime, and unemployment.

Unlike gold, Bitcoins’ durability is reliant on the durability of its network and the infrastructure that supports it. Even though Bitcoin is still relatively new, it has survived the last 14 years. This is despite attacks from the most sophisticated and well-funded branches of government, including the NSA.3

Divisibility

When we trade goods, it’s important that we can divide the goods into smaller pieces. This is important because it allows us to measure the amount of the good that we are trading more accurately.3

As with the example of trading pencils for a house, for the person selling the pencils it does not matter what the price of the house is as a house would cost several pencils. But if the owner of the house wanted a pencil, it would be difficult to sell part of a house for a single pencil. In this aspect of divisibility, pencils are a better money than a house.

Gold is divisible up to a certain point where it is no longer feasible. Fiat currencies are also divisible to an extent. Bitcoin too is divisible up to 100 millionth of a bitcoin which is incredibly small.3

Verifiability

Money needs to be verifiable to ensure its authenticity and prevent fraud. Verifiability means that the money can be checked and confirmed to be genuine. Verifiability also helps to prevent counterfeit money from circulating in the economy, which can cause inflation, and can also help to protect consumers and businesses from being defrauded.3

This can be done through various means for fiat currency such as markings, serial numbers, or other security features. For Gold, you will need to examine the entire piece with laboratory equipment. This is to ensure that what you have is not simply plated in gold and to ensure the corresponding concentration of gold is accurate (measured in carats). Bitcoin can be verified by any individual that has access to a fairly low power computer with internet connection.3 We’ll go through how this is possible in our “Bitcoin Anatomy” series.

Fungibility

Fungibility is the level at which you can distinguish one individual unit of money from the other. For example, it would be very hard to distinguish 1 ounce of gold in a bullion when melted into a ring. No one will be able to tell that the ring was made from that specific bullion of gold.3

Fiat currencies are fairly easy to trace given each individual note will have some identifying marking such as a serial number. If it was known that perhaps a particular batch of serial numbers was used by a criminal, it would be trivial with today’s technology to notify authorities the minute someone attempted to deposit it into a bank account.3

Bitcoin can be transmitted to any address and no one entity can prevent that transaction from occurring. Because Bitcoin transactions are made on a public ledger, all transactions are known, including where they came from and where they went. The individual Bitcoin address is considered pseudonymous in most cases. That is, an identity can be potentially linked to an address or a group of addresses. Exchanges that collect identifying information make this easier. This means that Bitcoin sent from a particular individual can be “blacklisted” by a government. If such a scenario occurs, it can give legal authority to prosecute a business or individual for accepting a “blacklisted” Bitcoin.3

There are layers being built on top of the “base layer” to give it added features including an added level of privacy. However, how people use Bitcoin will determine how fungible the whole system ends up being over time.

Portability

A good money would ideally be easily transported across space. The person you are trading with will not always be within walking distance. An ideal money should be able to move across the world with little effort and stored/secured easily.3

This is one of Gold’s biggest flaws. It is heavy and requires vaults for security. To transport significant value required, at times, a full military escort.3 This is one of the major reasons we do not use gold today in a fully-fledged global economy. We’ll explore this transition further in our second series of articles in “The Gold Standard”.

Fiat currencies are usually made of light small pieces of paper or metal that is relatively easy to transport. Its digital representations are easier to transport and secure but require trust in a third party such as a bank. Bitcoin is as portable as light itself. It’s just as easy to secure 1 dollar as it is to secure 1 billion dollars and requires no trusted third parties.

Although gold itself is not very portable, it still became the dominant form of money in many societies in different periods. This is because not all of these properties are weighted equally.

Scarcity

This is arguably the most important feature of good money. As discussed in our previous article, money goes through stages. The demand must equal or outpace supply in order for it to hold or gain value over time. Good money cannot progress through its “store of value” stage if its supply can be produced in abundance and with relative ease.1,3

Gold has an inflation rate of about 1.5-2% a year. When the price of gold goes up, the incentive to invest more energy into mining gold also increases, and so the supply increases with this slightly. Overall mining gold is energy intensive and costly. It is this “costliness” that limits its supply.3

Fiat currencies, such as the US dollar, do not have a set limit on their supply. The government and central bank have the discretion to decide when and how much money to create. 80% of the US dollars in circulation today were printed in the last two years. This is a common trend among fiat currencies around the world, with many countries making similar policy decisions.4

Bitcoin has a supply regime that decreases with time. After 140 years, there will be no more Bitcoin mined and the total supply will reach a cap of 21 million Bitcoin. This is embedded in the Bitcoin protocol. Apart from time itself, it can be argued that Bitcoin is the scarcest commodity in the observable universe.3

How important is Scarcity?

Historically scarcity has been the key feature of money for its adoption over time. It is the primary reason Gold won over its competitors. In the next article we’ll discuss some historical examples of primitive money and the consequences that occur when this property was violated.

References

- Mises LV. Human Action; 1940. p. 96.

- Menger C. The Nature and Origin of Value: Principles of Economics. Chapter III, The Theory of Value. 1871

- Boyapati V. The Bullish Case for Bitcoin. Medium. 2018 Available from: https://vijayboyapati.medium.com/the-bullish-case-for-bitcoin-6ecc8bdecc1

- Monetary Gold. Global Reserve Fiat Currencies: What Happens When They Fail? Available from: https://www.monetarygold.com/global-reserve-fiat-currencies/#:~:text=Fiat%20currencies%20have%20historically%20recorded,its%20%E2%80%9Cuse%20by%20date%E2%80%9D.

These articles were designed to make these concepts more palatable. If you’re interested in reading a more in-depth perspective on the concept of money, consider the following:

Robert Breedlove, “Money, Bitcoin and Time“

Saifedean Ammous, “The Bitcoin Standard: A Decentralised Alternative to Central Banking”. Wiley, 2018

Vijay Boyapati, “The Bullish Case for Bitcoin”

Robert Breedlove, “Masters and Slaves of Money“

Nick Szabo, “Shelling Out: The Origins of Money“

Ruki is a passionate Bitcoin educator who firmly believes in the principles of the Austrian School of Economics. As a sound money advocate he recognises its benefits to individuals and society as a whole. He is dedicated to empowering those without financial access to take control and build a more secure future.